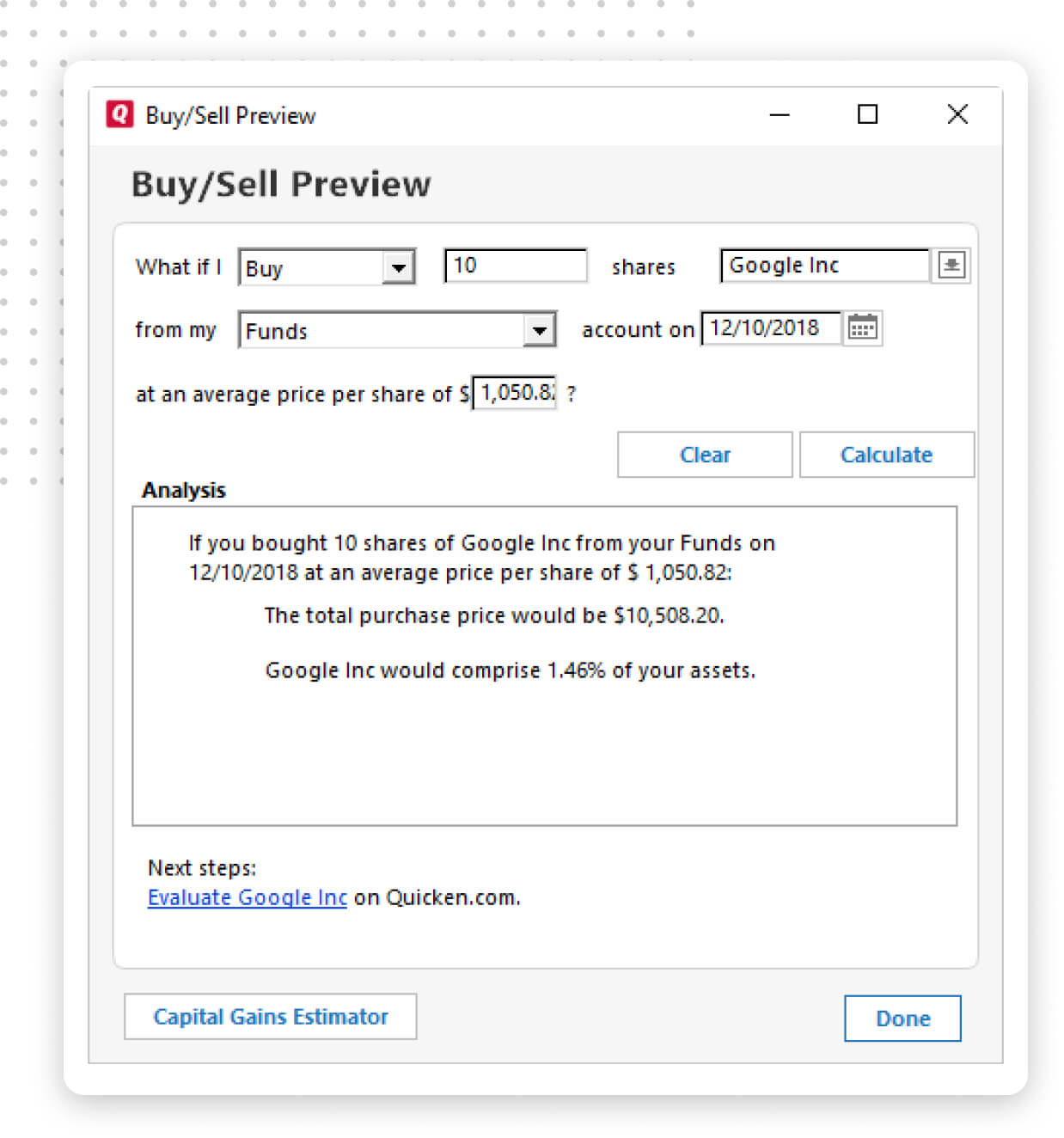

I was also disappointed that you can’t enter total transaction amounts when recording an investment transaction.

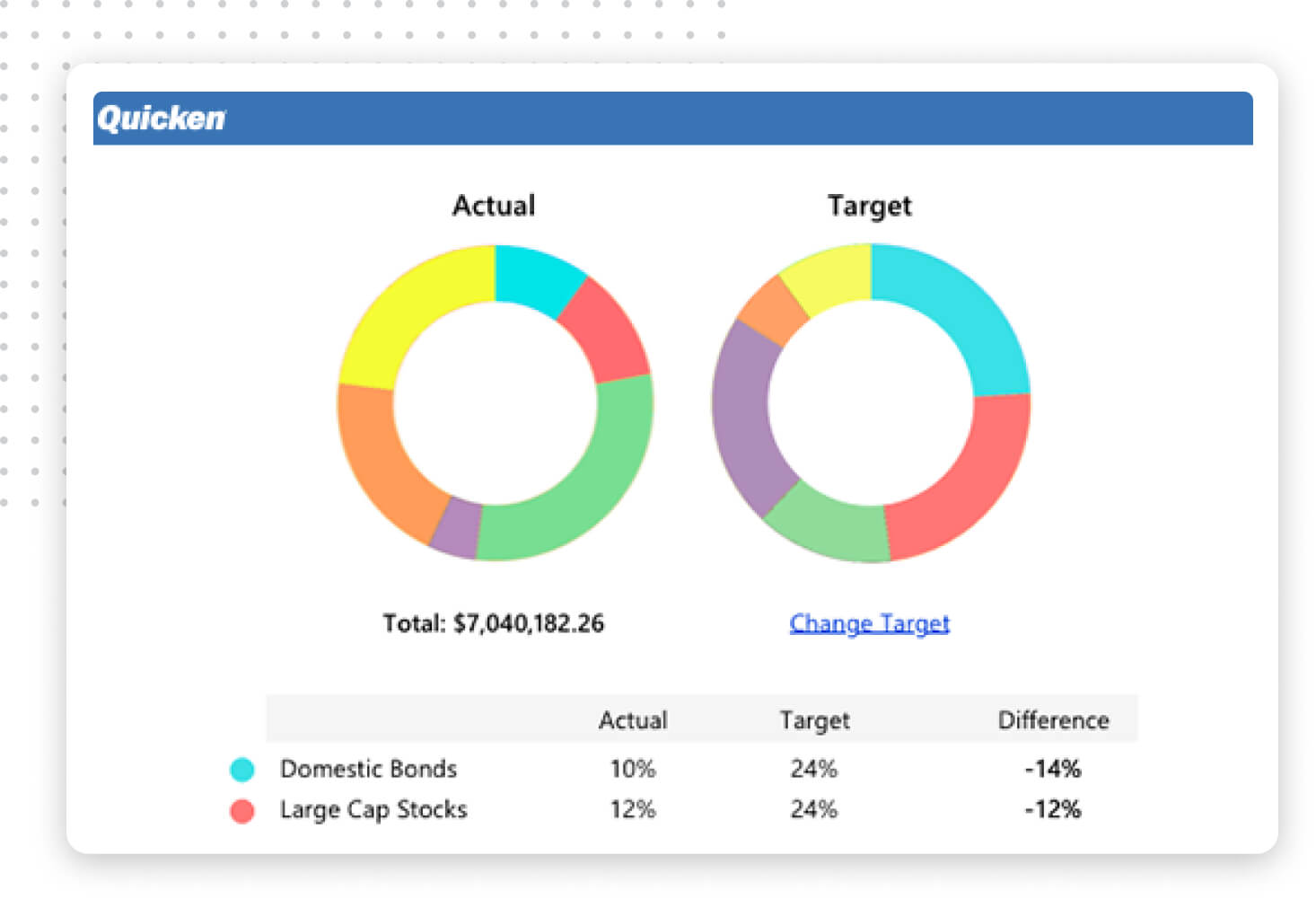

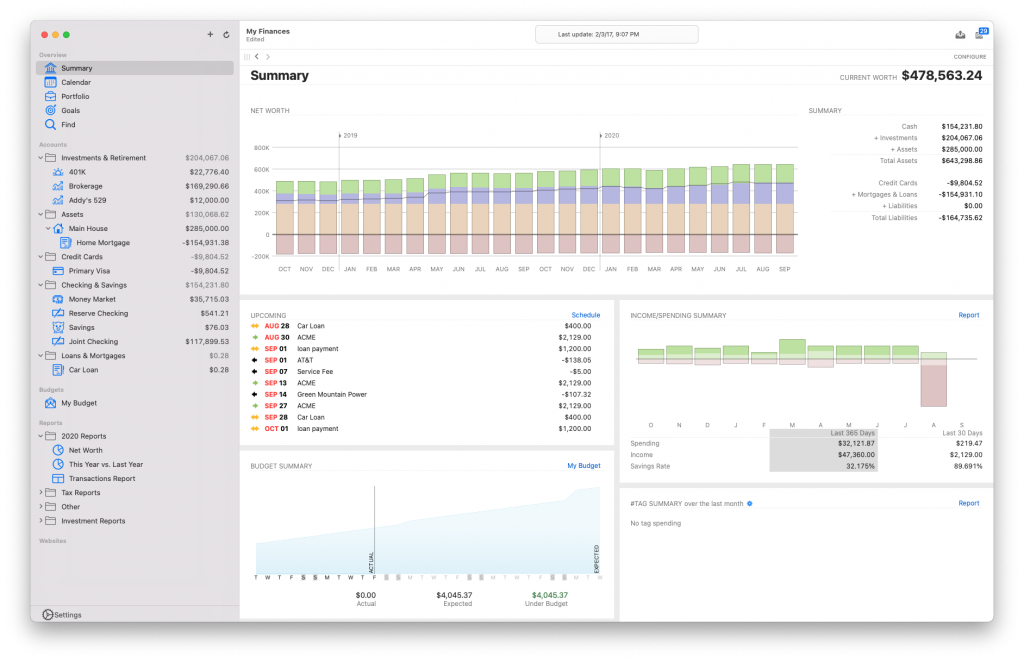

One tip here is to open your report in a separate window so you don’t have to wait for it to regenerate if you click in and out of it for any reason, but still… I miss the Quicken portfolio view. While you can access this info through a custom report, the report has to be generated on the fly each time you view it, so there’s a bit of a delay when clicking over to review your portfolio. small cap, etc.Īnother annoyance is that iBank lacks a default portfolio view where you can see share numbers by account, returns, etc. It would be nice to be able to specify things like domestic vs. Once again, this lack of customization isn’t a huge deal, but it could be an issue if you like to visualize your asset allocation with more granularity than Stock vs. For example, when looking at how securities are set up, you can’t customize the the investment “Type” or “Risk.” Rather, you have to choose from a pre-set list of plain vanilla options.

Slick! (And useful in other scenarios, as well.)Īs I dug deeper, however, I ran into some unexpected limitations and annoyances. From there you can simply delete the old account. You can’t change the account type after it’s created, but you can create a new account of the right type and then select all and cut/paste (be sure to cut and not copy!) the transactions into the new account. This comes in especially handy if you make a mistake when setting your account type. One particularly awesome feature was the ability to cut/paste transactions from one account to another. The built-in help files are extremely helpful, and IGG also hosts some very nice support forums where you can mingle with other users as well as support staff. It’s much prettier than my old version of Quicken, and it’s fairly easy to navigate. My first impression of iBank once I got everything imported and started poking around was that it’s a very nicely polished piece of software. Regardless, this cleanup step was very fast and easy. Moreover, as far as I could tell, most of these errors appeared to be Quicken artifacts as opposed to iBank import errors. Given the huge number of accounts and transactions that I was dealing with, I expected to find a number of errors, but there were surprisingly few. The easiest way to do this is to open Quicken alongside iBank and cross-reference the balances for each account to make sure that they agree. Okay, now that my data was in iBank, I needed to double-check the import and make sure there weren’t errors. For me, the only glitch at this point was that all bank accounts defaulted to checking accounts, and I had to change a few to savings accounts – though this is mostly a matter of aesthetics. Be careful with this step, as there’s no way to change account types after you create your file. Once the import is done, you’ll get a window that asks you to verify the account types. NOTE: If you’ve been using Quicken Essentials for Mac, you’re out of luck, as it doesn’t support QIF export. Once again, you may need to wait patiently at this step – it really depends on how much data you’re dealing with. When it comes up, tell it that you want to import from Quicken for Mac and then simply drag-and-drop your QIF into the window.

#QUICKEN FOR MAC INVESTMENT REPORTS INSTALL#

The next step is to install and launch iBank. This isn’t a huge deal, as most of our investments either have ticker symbols or are tracked as dollar-denominated investment – click through for more details on how I track CDs and Lending Club investments. In my case, this took a few minutes as I have a ton of data – when all was said and done, I wound up with a 1.8 Mb text file.Īlso note that Quicken is unable to export the price history for securities without a ticker symbol. In Quicken 2007, you can export to a QIF file by going to File > Export > To QIF. This is one of several data formats that Intuit has developed and then abandoned over the years, and it’s the preferred format for importing into iBank. Okay, back to the topic at hand… Getting your data out of Quickenįor starters, I had to export my data from Quicken into a QIF (Quicken Interchange Format) file. That should give you more than enough time to decide whether or not you like it – and if you do, simply register your copy and keep on using it.

#QUICKEN FOR MAC INVESTMENT REPORTS SOFTWARE#

While the good folks at IGG Software were kind enough to provide me with a review copy, iBank comes with a 30 day free trial that can upgraded to the paid version at any time. I’ll be providing lots of details below, but the executive summary is that iBank (currently version 4.2.4) is a great piece of software, though I’m not convinced that it’s right for me. Over the weekend I spent some time migrating my 14+ years of Quicken data from Quicken 2007 to iBank, which was at the top of my list of Quicken alternatives.

0 kommentar(er)

0 kommentar(er)